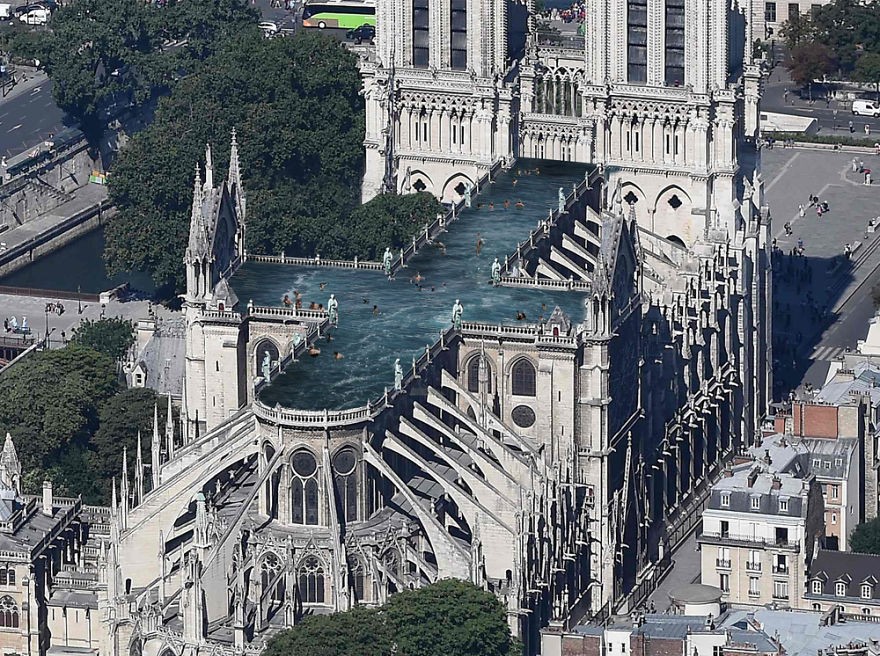

There has been a lot of controversy about the amount of money required to reconstruct France's most iconic cathedral and where that money should come from. The French government immediately committed to the reconstruction. It struck me that the Catholic Church itself, one of the wealthiest organisations in the world, would have been a better source for the funds than the French taxpayer, with the money having to be found from budgets such as Education, Health, Culture etc. Probably for this reason I had to smile when I saw some of the suggestions as to how the new roof design might look. I particularlly like the one above and the practical solution to local parking problems provided below.

Allan Hilder

According to research by the Pew Research Institute a significant proportion of Spaniards who grew up as Catholics have lost their faith in adulthood. The drop in adherents in Spain is one of the most pronounced in Western Europe. Only Belgium and Norway have seen a greater drop.

Of the respondents to their survey undertaken between April and August 2017, 92% stated thay had been raised Christinan (which in post-Inquisition Spain means Catholic) but only 66% remained Christian in adulthood as the graph below shows.

Of the 66% who consider themselves still to be Christian only 21% attend church at least once a month, slightly more than the U.K. but less than Austria, Germany or Switzerland.

Finally, the propertion of respondents who state that they are atheists, agnostics or have no religion is higher in Spain than all Western European countries surveyed apart from the Benelux countries and the Scandinavian countries of Norway and Sweden.

This research depicts a country that perhaps few people outside of Spain would recognise. It is certainly one of the most tolerant and socially liberal Western societies with a less negative opinion of muslims and with gay marriage and same sex-adopition legalised since 2005.

Spain is in an anomalous position with regard to separating the state from the Catholic church.

State schools are all lay institutions and religion is taught only as an option. In my daughter’s school the majority of students opt for Valores Éticos (Ethical Values) instead. This is an interesting choice encompassing debates about racism, citizens rights and obligations, discussion of news topics etc.

Following on from my article about the decline in those who regard themselves as Christians (a fall from 92% brought up as Christians to 66% who remain Christians in adulthood) it is interesting to note that only roughly half of that percentage (35%) elect to tick the box on their annual tax return (la casilla de la iglesia) that diverts taxes to the Catholic church.

However, this diversion of funds deprives the state of approximately €250 millions annually, a figure that has not declined despite the crises of the past ten years. So, where does this money go to? Much of it pays the salaries of 22.000 priests who receive €12.600 p.a tax free together with their accommodation and associated costs such as electricity, water etc. and the salaries of 113 bishops and archbishops who receive €17.500 p.a. plus accommodation, a car and chauffeur.

These salaries account for roughly 70% of the diverted taxes, the rest is paid over to the various dioceses for other expenses. Although there is a tacit understanding between church and state that services for followers are provided free there are a vast array of additional services that the clergy charge for, whether directly or as chaplains to prisons, hospitals, brotherhoods, teachers of religion in schools or colleges etc.

Partly caused by the banning of the minimum interest rate clause (la clausula suelo) in Spanish mortgages (see my earler article) there has been a dramatic shift from Base Rate Plus mortgages to Fixed Interest mortgages. At the end of 2015 Fixed Rate mortgages represented less than 10% of the total. By mid 2018 it was 40%.

This has been accompanied by a decrease in the average interest rate charged due, in part, to fiercer competition between financial institutions. Wheres in early 2009 the rate was 5.5% by Autumn 2018 it has dropped to 2.6%.

With the recovery in the economy and increasing property prices, there has been a commensurate increase in the number of mortgages granted which have grown steadily since late 2013. At around 30.000 per month they are a long way from the heights of the boom but the new law on mortgages whereby the costs are switched from the borrower to the lender is expected to boost the growth considerably. This is likely to accelerate the annual growth in property prices which stood at +7.2% for the thrird quarter of 2018.

Recently published data on the number of mortgages conceded by financial institutions continues to show a modest but sustained upward trend as the graph from Idealist below shows.

Rock bottom was hit at the end of 2013 but by late 2018 the number of mortgages granted, although a long way from the giddy heights of the boom years had returned to the levels of mid-2011.

Whether this growth will be maintained is uncertain as, although the economy is growing well, recent changes in legislation affecting the costs that banks must bear when conceding mortgages may place a brake on the market until these institutions work out how best to make money in a new environment.

From 1st January 2019 the socialist government of Pedro Sánchez increased the minimum wage by a whopping 22%, the largest ever increase since the minimum wage was introduced. The level is now set at €900 per month in a 14 month year (double payments were traditional in May and August) or €1.050 per month if paid on a 12 month basis. There is even a rumoured plan to increase it again in 2020 (if Sr. Sánchez manages to stay in office!) to €1.000 for a 14 month or €1.167 per month on a 12 month payment basis.

Most economists would applaud such an increase as the lowest paid tend not to have the chance to save but spend all of their income on daily living thereby pumping money into the economy. The likely effects of this move, according to some commentators were that it would drive more low paid jobs into the insecure black economy, lower the number of future hirings, raise the rate of inflation and cause the loss of existing jobs. It looks like this last fear may have come to pass.

In Spain there are thousands of people contracted and losing their jobs on a daily basis, partly because of the widespread use of fixed term contracts (usually of six months duration). On 1st January 2019 there were 274.000 losses a figure not seen for a decade. In 2018 there were 176.000 and in 2011 only 57.000. This may simply be a blip as the market adjusts and prices rise slightly to accommodate the rise in wages, which hits agriculture and the hotel industry hardest, both of which depend heavily on unskilled manual work such as harvesting and the cleaning of bedrooms.

So, what seems initially to be a boon to the lower paid may result only in workers being pressurised to increase productivity and/or a reduction in the hours worked.

The unemployment rate in Spain dropped, at the end of 2018, to its lowest level in a decade. From the peak of over 25% on 2013, the official rate has now fallen to 14.4%.

Although still high compared to the EU average of 6.6% or the Eurozone 7.9% it is perhaps as well to bear in mind the prevalence of cash in the Spanish economy. Many people, although officially unemployed, are receiving funds for work done outside of the official economy. And this applies to all walks of life, both employed and unemployed. Even architects and lawyers as well as painters and decorators, gardeners etc. like to enjoy part of their fees outside of the system.

Why else are 35% of all the Bin Ladens (€500 notes) in circulation in the Eurozone reputedly in Spain?

Although the overall level of property transactions are more than 30 % below their peak in the boom year of 2007, sales of existing houses, as opposed to new-builds, are fast approaching the levels seen in the boom. In 2018 422,500 used properties were sold compared to the height of 448.900 in 2007. More second-hand properties were sold in 2018 than in any year since 2007 and the trend is upwards.

Although this will definitely have an effect on prices, which are already on the increase as the graphs below show, in our particular niche of country properties, every one of them different, whether prices are rising, remaining stable or even falling depends more than anything else on the situation of the seller. My experience of prices over the past thirteen years is that we are still at a level very significantly lower than in the boom years and even now sellers will sometimes accept offers significantly lower than the price at which they are listed.

The following graphs and a table from two different sources provide a snapshot of how prices are moving in general and in Andalusia in particular.

TINSA - The largest firm of valuers in Spain

Movement of prices in Spain

According to data just issued by the Bloomberg Global Health Index, Spain ranks as the healthiest country in the world, replacing Italy, the leader in the last survey. The index is based on various factors including longevity, infant mortality, rates of obesity and tobacco consumption, the health system and access to clean water etc.

Currently second on the list is Italy followed by Iceland and Japan. Sweden is 6th, Norway 9th, France 12th, Netherlands 15th, the UK 19th, Portugal 22nd, Germany 23rd, Denmark 25th, Belgium 28th and the USA 35th.

I read an article recently which highlighted just how much Spain has changed since the death of Franco in 1975 and the adoption of the new constitution in 1978. Whilst many countries have experienced significant change in this period, Spain's transition from a dictatorship, under which industries producing poor quality goods were protected, to a modern democracy with an open economy, has seen a seismic shift. Entry into the European Union in 1986 has undoubtedly been one of the motors behind this change. Spain is still a net beneficiary of EU funds, although to a lesser extent than in the past, and this, together with a desire for political stability, explains why the Spanish are such enthusiastic Europeans. The table below shows just how great the change has been in the past forty years.

Banks, not borrowers, must pay the costs

The Spanish government, under pressure from the EU, has clarified who must pay what in terms of costs when a borrower agrees a mortgage loan with a bank. Previously, all charges were paid by the borrower and they were onerous. Now all of the charges, except a valuation of the property, must be paid by the bank and the abusive minimum interest rate clause (la cláusula suelo) has been banned. The charges involved are:

- Notary and Registry charges for the mortgage deed. Typically, for a loan of €200.000 these would be in the region of €700 - €900 added to which there is usually an administrative charge of, perhaps, €150.

- Taxation. It has always seemed anomalous to me that a person who is in need of finance to purchase a property must deliver a proportion of the loan to the government in tax. And the way in which it is calculated is nothing short of outrageous. The rate is 1.5% of the loan. But not just the principal. All of the costs that might possibly be incurred in punitive interest, legal and court costs in the event that the loan was never repaid. This adds, typically, a further 50% to the principal so the true rate of taxation is around 2.25% of the loan. The borrower of our €200.000 loan has, in the past, had to pay around €4.500 in tax. This must now be paid by the lender.

So, the borrower will now save some €5.500 in costs when taking out a loan of €200.000.

How will the bank recover these costs?

Firstly by becoming much more efficient. Banks have been in a rush to merge since the crisisi of 2007-2008. And even some of the mergers, have merged again. Branches have been closed at an extraordinarily rapid rate. Internet banking has caught on and clients are no longer prepared to queue at branches whose practices had changed little in decades.

On a recent trip through Sevilla province I stopped to meet a colleague at a roadside restaurant near Marchena.

I ordered a bottle of water while I was waiting. The waiter asked what tapas I wanted with the water. I opted for chipirones (baby squids). The dish arrived with a potato and red pepper salad. Delicious.

When I came to pay I could barely believe the cost €1.00. Yes, one euro. Only the water is charged for.

(Apologies for the dirty knife and fork. I'd already eaten one chipirone when I took the photo!)