The Spanish Digital Nomad Visa

What is the Spanish Digital Nomad Visa?

Recognising the significant rise in people's ability to work remotely, which was strengthened by the recent Covid pandemic, and a widespread desire to experience living in various locations, the Spanish government introduced at the end of 2022 a visa which would enable such people to reside temporarily in Spain. The government's motives were not altruistic. They were aware that such nomads are often highly paid professionals and Spain would benefit from both their spending power and their taxes. Spain is a very attractive location for people who are able to work remotely: the climate, excellent communications, fast internet speeds, low cost of living relative to most European countries, availability of coliving facilities and the friendliness of its people.

Who Is It Aimed At?

There are two distinct groups of people for whom the Visa is applicable:

- Full-time employees of a company who are allowed by their employer to work remotely.

- Self-employed people who generate their income from various sources outside of Spain.

Benefits of the Digital Nomad Visa

Residency in Spain: It offers a way to live legally in Spain for non-EU residents.

Travel within the Schengen Area: Digital Nomad Visa holders can travel freely within the Schengen Area, comprising 26 European countries. Three more: Bulgaria, Romania and Cyprus are due to enter the area in the near future.

Family Inclusion: The program allows the inclusion of family members, including spouses, children and dependent adults. Applicants will need proof via a certificate of marriage or civil partnership for a spouse, and proof of parental responsibility for children.

Ease of Application: The application process is straightforward and the administration has only 20 days in which to process the Visa.

Right To Work: Holders of the Digital Nomad Visa are free to work as freelancers in Spain.

Requirements to Obtain the Digital Nomad Visa.

The requirements are slightly different for the two groups mentioned above.

Work Requirements

For those employed by a non-Spanish based company:

The company must have been trading for at least one year and your contract with the company must state specifically that you are free to work remotely. You must have worked at the company for at least three months. You will also need to provide a certificate issued by Companies House confirming the date of registration of the company and the nature of its business.

For self-employed persons:

The companies for which you are working must be located outside of Spain and you will need a contract with one of them that states you will work remotely for them. This appears anachronistic because the majority of freelancers will not have written contracts with any of their clients. However, many will own a limited company for taxation purposes which can verify that they are required to work remotely…

You must have been working as a freelancer for at least three months and you need to demonstrate that you have an educational level and sufficient work experience to justify your application.

This could take the form of three years work experience in a related field, a bachelor's or postgraduate degree from a recognised university, equivalent vocational training or a qualification from, for example, a business school.

Once the visa is granted holders can work for Spanish based companies provided that they represent no more than 20% of your income.

Clean Criminal Record: Applicants should not have any criminal record in Spain or in previous countries of residence within the previous five years.

Health Insurance: Proof of valid private health insurance for the applicant and their family, which must be issued by a company licensed to operate in Spain.

Financial Stability: Applicants must demonstrate they have sufficient financial means to support themselves and their family members.

Minimum Age: The minimum age age requirement for the main applicant is 18, and any family members must be under 18 years old or be dependent adults.

Note: All documents in a language other than Spanish must be translated by an officially registered translator and bear the Hague Apostille. Documents only have a validity of three months.

Can Applicants Apply While In Spain?

Yes. A significant advantage of the application process is that the Digital Nomad Visa may be applied for whilst legally in the country under any other type of visa such as the 90 day tourist visa. In fact it is easier to apply whilst in Spain as, if you apply to the local consulate in your home country, there is an intermediate step before obtaining the Visa.

There are certain documentary requirements such as a certificado de empadronamiento which is a certificate from the local authority confirming you have taken up residence at a particular address. You will need to provide documentary proof such as a rental contract. Before applying for the Visa each applicant must also obtain a NIE (Número de Identificación de Extranjero). It is best to get a lawyer to apply for this.

Note: You are not eligible for a Digital Nomad Visa if you have been a Spanish resident at any time during the previous five years.

Minimum Income Level Required

This figure will change annually as it is related to the SMI (Salario Mínimo Interprofesional). The applicant, which must be an individual, not a couple, must demonstrate a multiple of 2 x the current SMI. For the first additional member of the family a further 75% x SMI is required, and for any subsequent member 25% x SMI.

Thus a married couple with two children would need to demonstrate existing income of 3.25 x SMI.

The SMI for 2023 is €15.120 per annum.

An individual applicant would therefore need to demonstrate an annual income of 2 x €15.120 = €30.240

An applicant with the same family mentioned above would need to demonstrate an annual income of 3.25 x €15.120 = €49.140

Alternatively, assets that guarantee the receipt of the appropriate income, such as bank statements, will be considered.

How To Apply

Your lawyer is the best person to handle the application. There are also specialist lawyers who do nothing else but obtain various types of visa for non-Spanish residents. Ask us if you need the name of a competent lawyer.

Validity Of The Digital Nomad Visa

The visa will be issued for a period of three years, after which it can be renewed for a further period of three years. After five years continuous residence, applicants may apply for permanent residence.

Taxation

Holders of a Digital Nomad Visa are not taxed as fiscal residents, even though they spend more than 183 days each year in Spain. This concession falls under what is known as the Beckham Law, named after the footballer. A five year period is granted under which the holder of a Digital Nomad Visa pays tax at a flat rate of 24%, up to an an annual income of €600.000 and 48% on anything above that figure. Furthermore, there is no requirement to file an annual return in respect of wealth tax and there are preferential rates of capital gains tax, for instance if you buy a house and sell it at a later date at a profit. Spain enjoys double taxation agreements with many countries so any tax paid elsewhere will almost certainly reduce the liability in Spain. There is no tax liability on dividends, rents etc. arising outside of Spain.

Welcome

A group of locations, some villages, some small or medium sized towns have formed an association to welcome Digital Nomads to their locality. Check out their website which offers full details of each locality, internet speeds available, the cost of living and what office space is available for working, if required.

Coliving

If you want to live with others on a monthly rental basis in a rural or urban environment, there are many options available:

https://coliving.com/es/companies/spain

https://teletrabajamos.es/los-7-mejores-colivings-de-espana-para-teletrabajar/

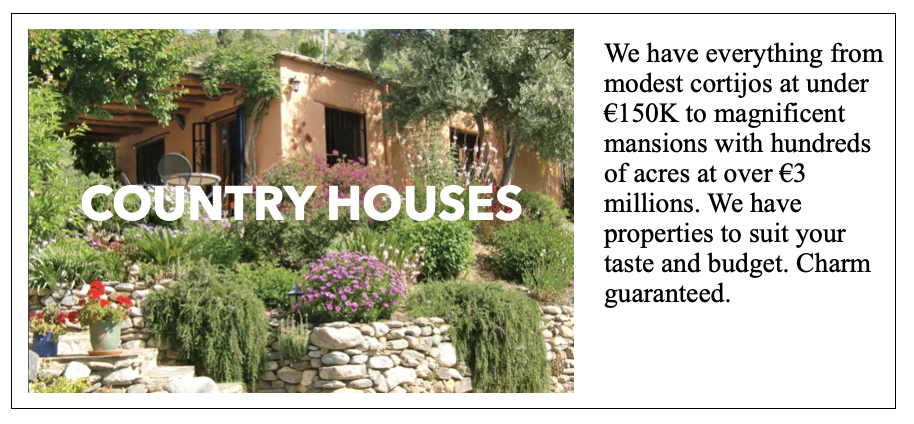

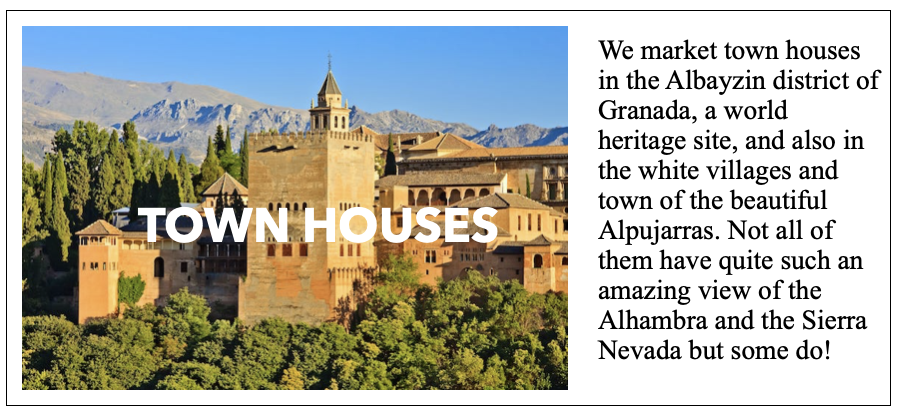

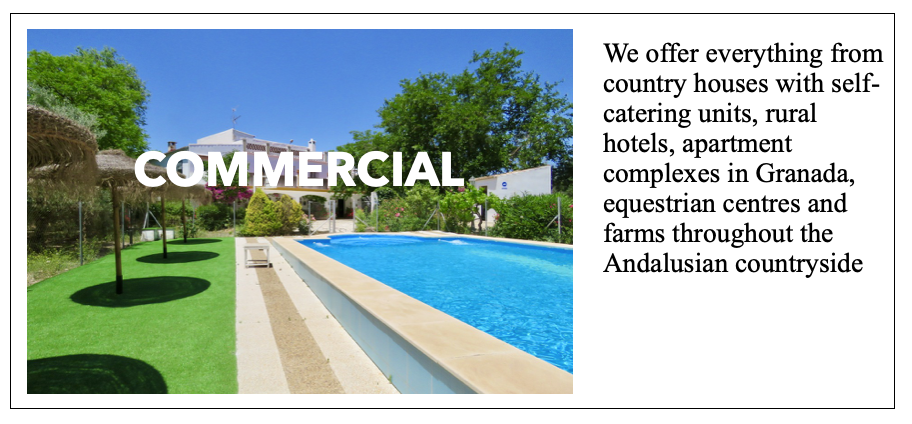

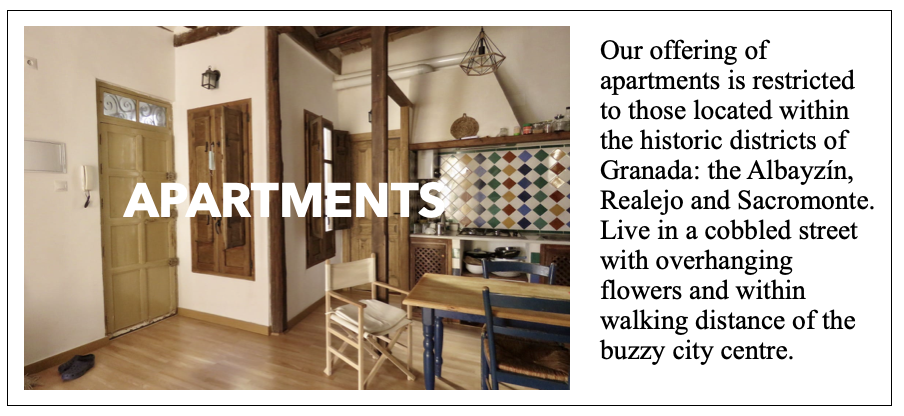

If you are interested in moving to Spain, and in particular to Granada or the wonderful Andalucia countryside, click any of the links below to view our current offer:

This information is provided in good faith and is not intended as legal advice. Cases may vary according to personal situation and the region in which application is made. Contact a competent lawyer before submitting an application.